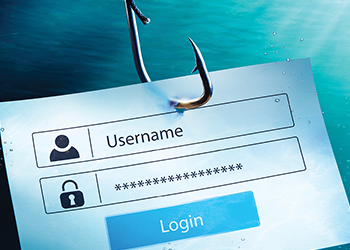

Protecting Yourself from Phishing, Smishing, and Spoofing Scams

May 1, 2025

Scams are always evolving, and cybercriminals use emails, text messages, and fake websites to steal personal information. Understanding these tactics is the first step to protecting yourself—and your personal information.

Continue readingProtecting Yourself from Phishing, Smishing, and Spoofing Scams

Pay It Safe with Zelle®

April 2, 2025

We know getting money to friends and family quickly and safely is important, so we've provided some friendly reminders on how to "pay it safe" when you're sending money with Zelle®.

Connect for the Cause: Message from Carrie Birkhofer, President & CEO

March 21, 2025

As a not-for-profit, member-owned credit union, we reinvest our earnings to directly benefit you. Because we are tax-exempt, we can keep money local, supporting our community instead of sending funds to the federal government. But now, Congress is looking at how to fund priorities by examining the tax policy. It is important that they don’t take away the credit union tax exemption.

Continue readingConnect for the Cause: Message from Carrie Birkhofer, President & CEO

Bay Federal's Annual Meeting is on May 20, 2025

March 7, 2025

Our Annual Meeting, open to all members, will be held on Tuesday, May 20, 2025 at 6:00 PM. Join us at our Capitola Branch for an informational summary of our 2024 financial and member service results.

As part of the Annual Meeting, the following members have been nominated by the Nominating Committee to fill three expiring terms on the Board of Directors: Taylor Bateman, Jessica Dixon, and Dennis Osmer.

To RSVP for the Annual Meeting, please call 831.477.8504 or email annualmeeting@bayfed.com. We look forward to seeing you there!

Important Security Alert: Stay Safe from Fraudulent Sites

March 6, 2025

In recent times, we've observed a notable increase in the number of fraudulent websites aiming to deceive individuals across the financial sector. This includes sites that falsely claim affiliation with Bay Federal Credit Union, explicitly targeting our community with the intent to commit phishing attacks.

Continue readingImportant Security Alert: Stay Safe from Fraudulent Sites

Message to our Members on Support in Uncertain Times

January 30, 2025

At Bay Federal Credit Union, we are committed to serving every member with care and respect. As a not-for-profit, member-owned cooperative, we believe in inclusion, empowerment, and community strength.

Continue readingMessage to our Members on Support in Uncertain Times

The 5 Factors That Affect Your Credit Score

January 1, 2025

Whether you’re looking to get your first credit card for everyday expenses or take out a mortgage to purchase your first home, credit is an essential tool for helping people to meet their financial goals.

Protect Yourself from Remote Access Scams

November 15, 2024

We are aware of an increase in Remote Access Scams targeting local community members by impersonating trusted organizations, including financial institutions. These scammers hope to gain unauthorized access to your devices and personal information.

Watch Out for Password Reset Scams

October 10, 2024

In our tech-savvy world, password reset scams are becoming all too common. Scammers often pretend to be from trusted organizations to trick people into giving away their sensitive information.

Community Support: What is Going on in September?

September 1, 2024

We’re thrilled to support several events this September, and we’d love to see you there!

Continue readingCommunity Support: What is Going on in September?